Can Ultrasonic Be An Alternative Solution For Tap-To-Pay When NFC Isn’t Present?

Near Field Communication (NFC) has been a cornerstone technology in the contactless payments landscape in many parts of the world. With an estimated market value of $30.47 billion in 2024, NFC’s rise has primarily depended on mobile payments.

However, NFC’s limitations – including its reliance on proximity, specialized hardware, NFC-enabled consumer devices, and consistent online connectivity – spotlight the necessity for alternative solutions. The quest for seamless, contactless payment solutions has never been more pressing.

Ultrasonic technology offers a powerful alternative solution to NFC to overcome these challenges, especially in areas with limited or nonexistent NFC infrastructure or inconsistent Internet access. Bolstered by the surge in contactless payment adoption and the heightened hygiene concerns brought about by the COVID-19 pandemic, data-over-sound has the potential to offer a novel approach to tap-to-pay functionalities and beyond.

So, how exactly does ultrasonic technology stand as a potent NFC alternative for tap-to-pay? Let’s take a look.

TLDR; Key Takeaways

- Ultrasonic technology provides a secure and efficient alternative to NFC for tap-to-pay transactions.

- Data-over-sound can function optimally in scenarios where NFC availability is limited or non-existent or consistent online connectivity isn’t possible.

- Ultrasonic data can be transmitted over greater distances without the Internet, which overcomes NFC’s limitations in global adoption and scenarios for underserved populations.

- These sound-based solutions mitigate common NFC vulnerabilities and risks like payment processing fraud, eavesdropping, and replay attacks.

- Ultrasonic payment solutions can transform various devices into payment terminals, broadening the scope for contactless payments beyond current NFC capabilities.

Introduction to NFC and Its Limitations

NFC technology was a breath of fresh air in the world of transactions, turning the tedious task of paying for your coffee into a magic tap-and-go ritual.

But its journey to global superstardom hasn’t been all rainbows and unicorns.

Infrastructure headaches and those pesky security bugs have thrown a few wrenches in the works (that’s “spanners” for our UK friends), making the road to widespread retailer adoption a bit of a rollercoaster ride.

History of NFC in Tap-to-Pay Ecosystems

Remember the early 2000s? Y2K fears had just died down, and then boom, NFC came onto the scene, promising to revolutionize how we pay for stuff. It was like suddenly finding a secret passageway in your favorite video game. With its cool inductive coupling trick, NFC technology lets your smartphone and the payment terminal have a private chat, exchanging payment info with a wave or a tap. No more digging for change or swiping cards like it’s 1999.

This was a minor upgrade to our shopping sprees and a giant leap towards the future.

Mobile payment systems like Apple Pay and Google Wallet jumped on the NFC bandwagon, and before we knew it, tapping to pay was the new norm. From paying faster to adding a layer of security, NFC made the old swipe-and-sign method look like sending a postcard with your bank details written on it.

How NFC Works in Tap-to-Pay

Behind the scenes in a tap-to-pay event, NFC is quite particular about how a transaction occurs. For starters, it requires that the customer’s phone and the store’s terminal are practically touching (technically, within 4 cm). Both devices must know the secret handshake (a.k.a. support NFC) to facilitate the data exchange.

Since the transaction requires a solid Internet connection to carry the payment through the exchange of data in the digital ether, the transaction is severed if the Internet is insufficient.

Here’s what the NFC process looks like:

At the heart of NFC’s operation is the principle of inductive coupling, which allows two portable devices—such as a smartphone and a payment terminal—to communicate via electromagnetic fields when brought within 4 cm of each other. This proximity requirement triggers a secure exchange of payment information without physical contact, initiating the transaction process. Once the terminal’s signal is activated, the NFC chip within the customer’s device transmits encrypted payment details for processing. This method speeds up transactions and enhances security by minimizing risks associated with the physical handling of payment cards.

The Challenge with NFC Adoption in Retail Environments

Let’s talk about the rollercoaster ride that is NFC adoption in the retail world. While NFC has been a game-changer, making payments quicker and safer, it’s also had its fair share of “But wait, there’s more” moments, reminding us that even the most remarkable tech can have its limits.

Security

First off, the elephant in the room: security. We’ve all heard the stories—lost or stolen contactless cards getting a little too friendly with fraudsters, no PIN or signature needed. It’s like leaving your digital front door unlocked. This glaring issue is making everyone, from your local coffee shop to big retail chains, question if the simplicity of tap-to-pay is worth the gamble.

Instability

And then there’s the issue of NFC’s picky nature. It demands both the shopper’s device and the retailer’s terminal be on the same tech page, not to mention the need for an uninterrupted Internet connection to process payments. Imagine the frustration in areas where the Internet plays hide and seek or communities where the latest gadgets are more of a luxury than a given. The push for a digitized globe revealed NFC’s Achilles’ heel—its limited reach and compatibility issues across different technological landscapes.

Too Impersonal

Retailers are now in a dilemma. In the rush to make everything quick and contactless, we may have missed the mark on connecting with customers personally. Remember the days when a cashier would comment on your choice of snacks? Now, it’s all beep and go. There’s a growing realization that the tech supporting our shopping habits needs to do more than just speed things up. It should also open doors to deeper engagement, like personalized offers that make you feel seen, not just scanned.

In essence, the retail world is on the hunt for a tech superhero who’s secure and speedy and brings a personal touch to the table, reaching every corner of the globe without breaking a sweat. NFC has laid some solid groundwork, no doubt. It’s fast and user-friendly and has introduced the payments space to the possibilities of contactless transmissions. But as we look ahead, we’re craving solutions that can go the extra mile, ensuring no shopper or retailer is left behind in the digital dust.

The Rise of Ultrasonic Technology as an NFC Alternative

Ultrasonic technology has emerged in the last decade as a viable NFC alternative, addressing many of NFC’s limitations related to global adoption, online connectivity, and security loopholes.

Retailers need to consider personalization as a future benefit when looking for tap-to-pay alternatives to NFC.

For today’s global retailers, the quest for a payment solution that combines the ease of NFC with a more personalized touch has been a bit like searching for a needle in a digital haystack. Ultrasonic technology could just be the magnet they need, offering a way to make every transaction feel less like a routine and more like a tailored experience.

What Is Ultrasonic Technology?

Ultrasonic technology uses sound waves to transmit data between devices, offering a versatile and secure method for contactless payments without the constraints of NFC’s proximity requirements or Internet connectivity. This tech, also referred to as “data-over-sound,” turns sound into a digital courier, carrying data over airwaves and bypassing traditional barriers like NFC’s need for close contact and constant Internet access.

Ultrasonic technology operates on a principle that is both simple and sophisticated. By emitting sound waves at frequencies beyond the human audible range, it establishes a secure channel for data transmission.

Here’s how it works:

This isn’t just theoretical tech magic; big names like Visa, Mastercard, Clear, Google, and many other innovative companies across every retail, merchant, and mobility sector are already harnessing ultrasonic waves to revolutionize how we think about proximity technology. From speeding through transit gates to snagging that latte on a morning run, ultrasonic tech is making its mark as the invisible link in an interconnected world.

Benefits of Ultrasonic Over NFC

Ultrasonic technology doesn’t just sidestep NFC’s hurdles; it leaps over them with the grace of a tech-powered gazelle:

Long-Distance Data Transmission

Where NFC’s reach is a mere handshake away, ultrasonic tone profiles can be configured for close proximity or to travel across rooms, making the “tap” in tap-to-pay more flexible and reliable.

No Internet? No Problem

This tech doesn’t blink during Internet outages. With ultrasonic waves, transactions flow as smoothly in regions with less advanced technological infrastructures as they do in a bustling city, making digital payments truly borderless.

A Fortress of Security

In a world where digital eavesdroppers lurk around every corner, ultrasonic technology fortifies its walls by supporting the enablement of advanced encryption. This turns every transaction into a secure exchange immune to NFC’s common vulnerabilities, like replay attacks and eavesdropping.

How Ultrasonic Payment Works: A Technical Insight

Significant advancements in ultrasonic technology have aided in security, efficiency, and global adoption in the last decade. As an alternative to NFC, ultrasonic technology is carving out its niche, proving that it can achieve seamless transactions without the traditional hang-ups of close proximity or NFC/Internet dependency.

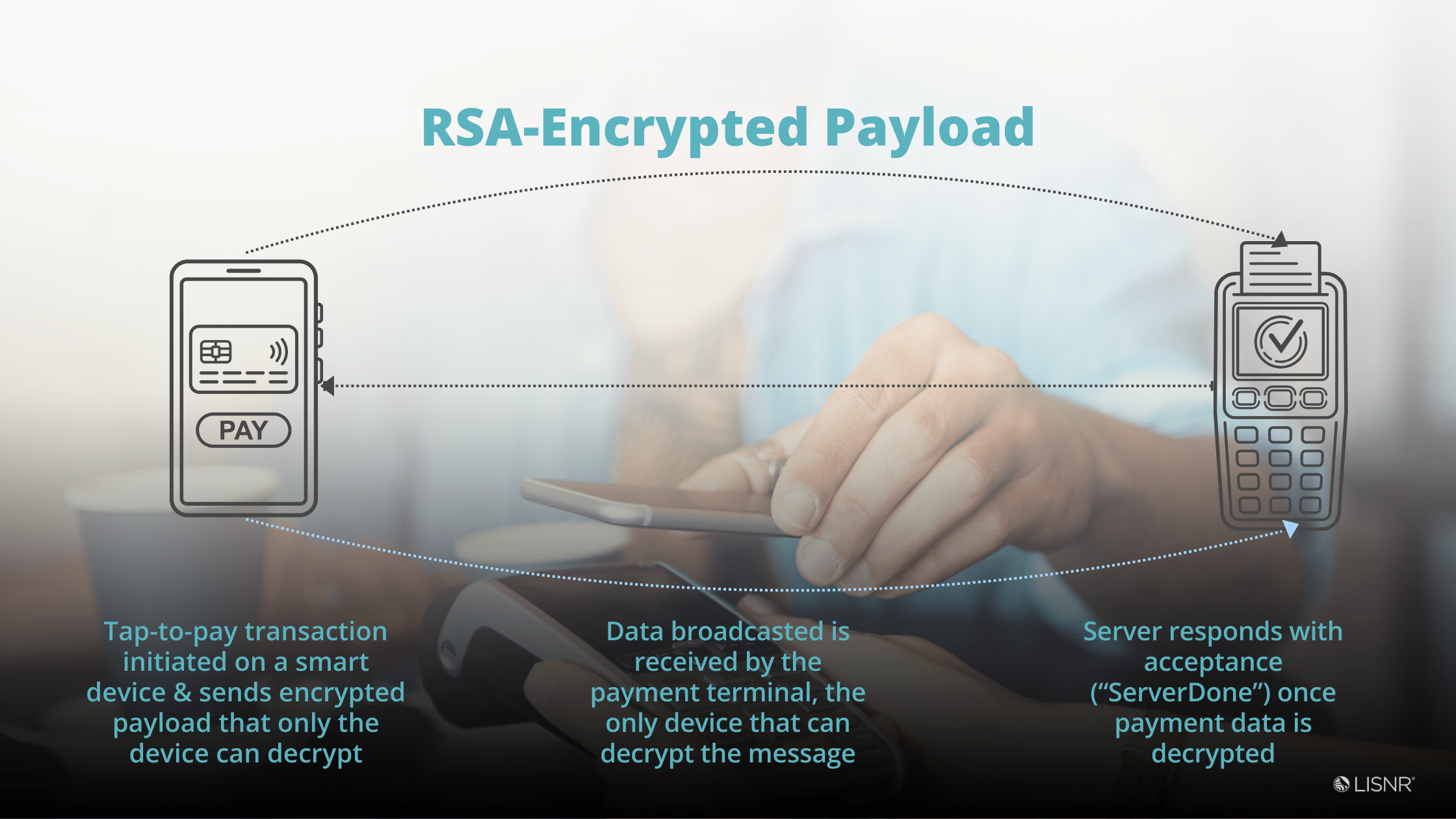

The Process Behind Ultrasonic Payments

Imagine your customers being able to conduct transactions as effortlessly as sending a text message without worrying about network availability or physical contact with nearby devices. That’s the promise of ultrasonic payments.

Through the emission of encrypted sound waves from one device to another, ultrasonic payments facilitate secure transactions without physical contact or the need for online connectivity, sidestepping NFC’s main vulnerabilities. Here’s how it works:

- Ultrasonic payments transmit data using sound waves at frequencies above the human hearing range (typically above 20 kHz). (Note: Most LISNR tones cap out at just under 20kHz in the “near ultrasonic” range, but when a transceiver type uses two Point profiles, the high-end frequency is just over 20kHz.)

- This process begins when a payment terminal generates an ultrasonic signal encoded with payment information.

- This signal is then captured by the microphone of the receiving device, such as a smartphone, where specialized software decodes the information.

- Data is encoded into these sound waves using sophisticated signal processing methods to secure the payment details during their airborne journey.

- Once the receiving device decodes this data, it returns the transaction details to the payment terminal, completing the process without needing an Internet connection or NFC’s close proximity requirement.

The technical underpinnings of ultrasonic payments reveal a key advantage: the ability to conduct secure transactions in any setting. This includes environments where traditional digital payments face challenges, such as areas with unreliable Internet service or situations where contactless payments need to be as frictionless as possible.

Benefits of Ultrasonic Payments in Retail

Ultrasonic technology in retail expands the potential for global payment solutions and offers a unique opportunity to enhance customer experience with the promise of convenience and security.

For retailers, ultrasonic technology can reimagine the customer experience; transactions can occur in the most remote locations or the busiest urban centers without a hitch. The absence of a need for online connectivity or NFC’s proximity limitations opens up new avenues for customer engagement, inventory management, and service delivery, so your business stays ahead of the curve in accessibility and convenience. Let’s dig into a few key benefits of using ultrasonic technology as an alternative to tap-to-pay.

Go Global Without a Hitch

Think of ultrasonic payments as a passport to worldwide sales, minus the jet lag. This tech doesn’t sweat if the Internet goes offline—it can function off the grid. For retailers looking to spread their wings and reach out to customers in far-off places or spots where Wi-Fi is inconsistent, ultrasonic technology can continue facilitating payments.

Make Shopping Snappier

Shopping with ultrasonic payments is like upgrading to the express lane every time. Customers zip through their purchases without getting bogged down by the usual payment drama, especially in bustling spots where every second counts. It’s all about keeping things moving smoothly, making sure shoppers leave with a smile and plans to come back.

No More Personal Space Issues

Forget about having to cozy up to the payment terminal—ultrasonic payments don’t mind a bit of distance. With configurable tone profiles, customers and cashiers don’t have the friction or frustration of making the perfect tap to conduct a payment. It’s a small change that greatly affects how we all think about checking out.

Staying Ahead of the Game

Ditching the need for a solid Internet connection, retailers can offer a level of accessibility and convenience that’s genuinely innovative and reliable. Ultrasonic payment technology smooths the shopping process and plants a flag in the ground, showing that a retailer is all about customer satisfaction.

In short, bringing ultrasonic payments into the retail mix is a game-changer, creating a shopping experience that’s more inclusive, efficient, and just plain cool. It’s about giving retailers and shoppers alike a glimpse into the future of payments—where convenience and connectivity converge to make buying and selling a breeze.

Compatibility and Security Features

We’ve touched on how ultrasonic technology, which offers compatibility with current devices and employs robust security features to protect against common NFC risks, enhances consumer trust in contactless payments. Let’s look closer at the compatibility and security features of data-over-sound.

Universal Compatibility

Ultrasonic technology is like the life of the party in the digital payment sphere, effortlessly connecting with a wide range of consumer devices. It doesn’t matter if your customers use the latest gadgets or cling to older, trusty tech; ultrasonic payments include everyone. This broad compatibility revolutionizes retail, ensuring you can serve every customer with no tech left behind. Hosting this inclusive party means nobody worries about being on the guest list based on the device they carry.

Unbreakable Security

When it comes to security in the digital realm, ultrasonic payments set a high bar. They provide the option to wrap each transaction in layers of sophisticated encryption and tokenization. Keeping data safe can build a genuine trust bond with your customers. They can shop with the assurance that their payment information is shielded from eavesdropping, replay attacks, and fraud. For retailers, this is a pledge of safety and reliability to your customers, enhancing loyalty and trust in your brand.

By harmonizing these capabilities, ultrasonic technology narrates a compelling story for the future of retail. For leaders and innovators in the field, adopting ultrasonic payments signals a commitment to a secure, inclusive, and tailored modality that meets the evolving needs of customers and the market.

This strategic choice positions you at the forefront of the retail revolution, where transactions are seamless, accessible to all, and fortified against the challenges of the digital age.

How to Implement Ultrasonic Solutions in Retail

For retailers eyeing a switch to ultrasonic payment solutions, the journey is less about overhauling your existing setup and more about making intelligent tweaks. Let’s break down how you can bring this tech into your retail game.

Steps for Adoption by Retailers

The beauty of ultrasonic tech lies in its low dependency on complex infrastructure. It thrives without a constant Internet connection and stands firm against the security challenges that often shadow NFC transactions. Retailers can integrate ultrasonic payment solutions with minimal infrastructure changes, benefiting from their independence from online connectivity and their resilience against security threats inherent to NFC.

Here are a few areas to consider:

1. Evaluate Your Current Tech Landscape

Take a good look at your existing payment systems. Understanding where you’re starting from helps in planning the integration of ultrasonic solutions with precision. This is where NFC solution providers (and alternative to NFC solution providers) can offer insights into the capabilities of your current setup and suggest enhancements or replacements necessary for ultrasonic technology adoption.

2. Partner with an Ultrasonic Tech Provider

Seek out the mavens in ultrasonic payment technology. These partnerships can provide you with the necessary toolkit and guidance to make the transition smooth. (We’d be remiss if we didn’t mention LISNR as a place to start.) Partnering with an alternative to NFC solution provider like LISNR, which specializes in ultrasonic payment solutions, can facilitate access to innovative technologies not traditionally offered by regular NFC solution providers.

3. Train Your Team

Make sure your staff is up to speed with the new system. A well-informed team can provide better support to customers during the transition, leveraging the expertise of your new tap-to-pay solution provider to maximize the benefits of ultrasonic technology.

4. Pilot the Technology

Think regionally before rolling out globally. Test the ultrasonic payment system in select locations to gather insights and iron out any kinks before a full-scale rollout. This phased approach is commonly recommended by tap-to-pay solution providers to help assess the technology’s impact and effectiveness in real-world scenarios.

Infrastructure Requirements and Setup

Setting the stage for ultrasonic payments in your retail environment is more straightforward than you think. It primarily involves software updates to enable your systems to process ultrasonic transactions and equip your space with speaker devices capable of sending or receiving ultrasonic signals.

However, you’ll first need to identify which upgrade path offers the least resistance: changing the process flow or appending existing tech.

Hardware Compatibility

Contact your provider to determine if your validator allows for a microphone and if you have the flexibility to change the data flow. Generally, the PSP provider offers this flow method. If not, you should determine the upgrade path to new gadgets that are ready to send or receive those high-frequency sound waves.

Software Integration

Once your hardware is solidified, update your tech stack with a data-over-sound SDK like LISNR Radius to decode ultrasonic signals. This software acts as the bridge between the ultrasonic data transmission and your transaction processing system.

Customer Communication

Let your customers know about the new payment method. Educate them on how it works and its benefits to their shopping experience.

Conclusion: Why Ultrasonic Might Be the Key to Universal Tap-to-Pay

As we zoom out to look at the big picture, it’s clear that ultrasonic technology is shaping up to be the heavyweight champion in the tap-to-pay alternative universe. By tackling NFC’s shortcomings head-on, ultrasonic payments bring to the table the kind of security, accessibility, and global reach that could very well set the new standard for how we transact in the future.

Imagine a world where paying for your coffee, catching a train, or picking up groceries is as simple and secure as sending a sound wave through the air. That’s the promise of ultrasonic technology.

Predictions for Payment Technologies

The adoption of ultrasonic technology is expected to rise, driven by its advantages in security, range, and independence from Internet connectivity, addressing the critical needs of a global customer base. Its standout features—like military-grade security without the need for an Internet handshake and the ability to shout (well, whisper) payment info across a room without interference—are exactly what the global market needs.

The adoption of ultrasonic technology is expected to rise, driven by its advantages in security, range, and independence from Internet connectivity, addressing the critical needs of a global customer base. Its standout features—like military-grade security without the need for an Internet handshake and the ability to shout (well, whisper) payment info across a room without interference—are exactly what the global market needs.

As retailers and consumers yearn for payment methods that keep pace with our connected yet often unstable online world, ultrasonic tech is now available to answer the call.

The Role of Consumer Preferences in Technology Adoption

Let’s remember the most critical players in this game: the consumers. Their growing demand for safe, sound, and universally accessible payment options is steering the ship of technological innovation in contactless payments and alternatives to NFC.

Ultrasonic technology, with its unique blend of features, is hitting all the right notes, offering up a solution that could very well redefine the checkout experience. The tides of consumer preferences are shifting into a future where everyone, everywhere, can tap to pay with confidence.

So, here’s to the ultrasonic revolution—a sound wave set to ripple across the world, changing the way we think about tapping to pay, one transaction at a time. The leap towards democratizing digital payments signals a global shift towards more inclusive, secure, and user-friendly payment methods, marking a pivotal moment in the ongoing evolution of how we transact.